So if you’re someone who tends to tear through your monthly income before paying your bills, you’re better off trying a budget with more structure. My review: With no distinction between “wants” and “needs,” this technique offers you a lot of freedom. Any budget that helps you do that is a successful one.” “The important thing is that you hit your goals. “You can have as many or as few guidelines as you want in budgeting,” says Jeff Farrar, a Wilton, Conn.-based certified financial planner who teaches a budgeting course at Fairfield University. Whether that’s a good or bad thing depends on the person. What the experts say: There’s less structure to this one. Who it’s for: People with comfortable incomes who don’t tend to overspend, especially those who plan to donate to charities or causes. The calculations here are simple, so you can use an app or spreadsheet, or simply do the math in your head. There’s no distinction between your fixed costs and your disposable income-they’re all lumped into the same 70%. You divide your posttax income into three categories: 70% for monthly spending, 20% saving and 10% donations and debt repayment above your minimums. How it works: This seems a lot like the 50/30/20 budget but the percentages lead you to different results. For me, 50/30/20 was a good baseline, but if you live on a modest salary in an expensive city with dreams of homeownership, having 30% left over for your “wants” category is a pipe dream. I didn’t want to cut back on that, so I ended up panicking and bumping my total savings contribution up to 25% after a few weeks. In addition to whatever we put toward our retirement nest eggs-usually at least 5%-my partner and I have made a habit in recent years of putting 20% of our income into a joint savings account for big future expenses. Meanwhile, the 20% savings threshold didn’t feel like enough. My review: I found it impossible to trim my needs bucket down to 50%. “So you’ll end up going over with your needs and not having enough for the other categories.”

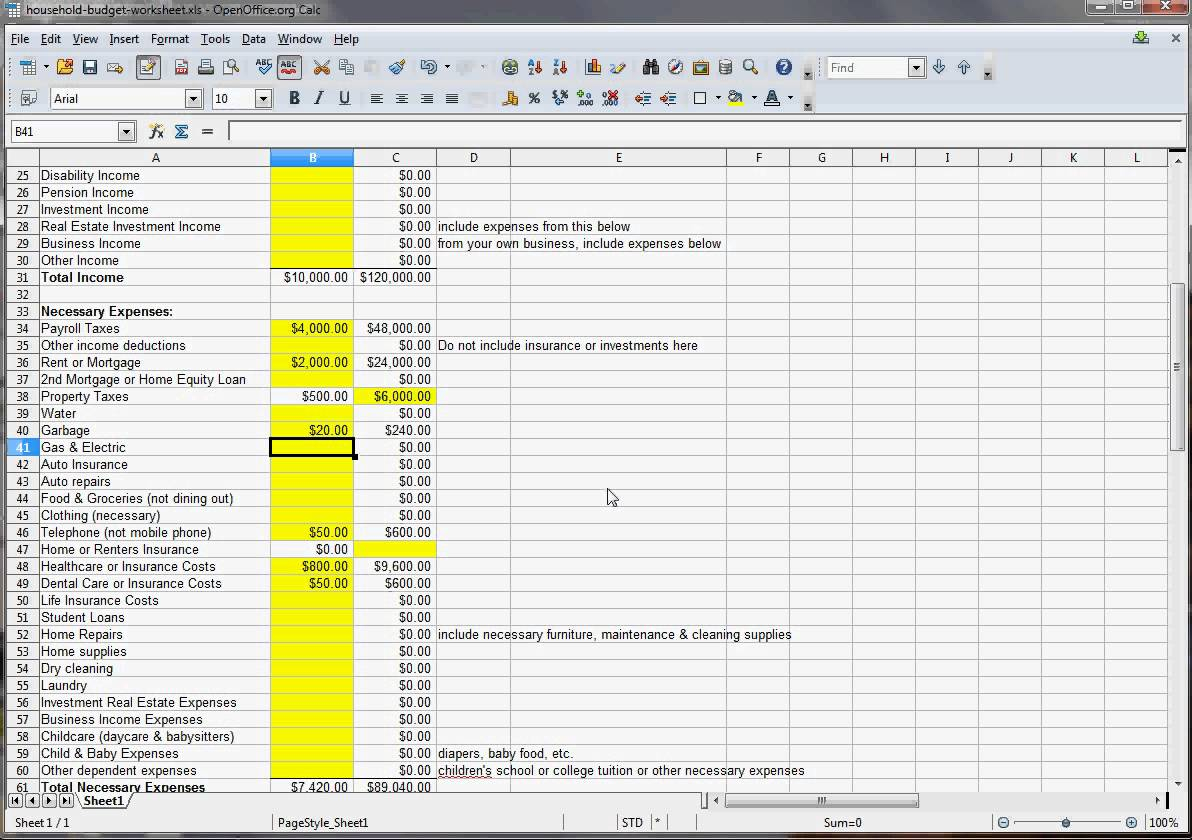

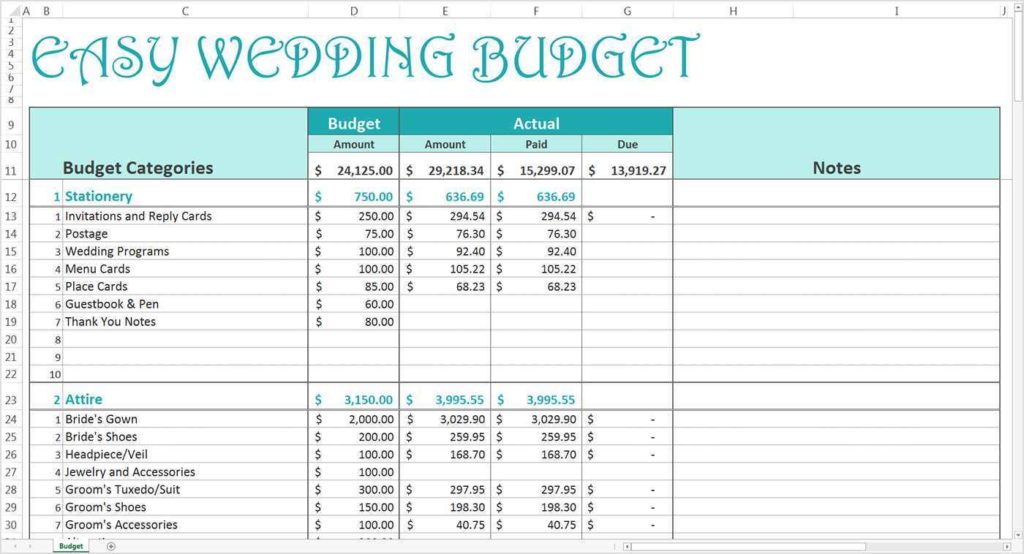

“For places with higher costs of living like New York, New Jersey, or California, housing alone can eat up 35 or 40 percent of your budget,” says Giardino. But its feasibility depends on where you live. It’s straightforward and easy to grasp, since every expense fits neatly into a category. What the experts say: The 50/30/20 is a go-to for many financial planners. Who it’s best suited for: People with fairly stable monthly incomes and expenses. You need to divvy up your take-home pay into buckets: 50% goes toward needs (housing, car payments, groceries, insurance, student loan payments and other debt minimums), 30% toward wants (trips, dining out, entertainment, gadgets, etc.), and 20% toward savings (retirement, emergency funds, and debt payments above minimums). You’ll need a spreadsheet or a budgeting app, such as Mint or You Need a Budget, for this one because it involves tracking and doing some math.

How it works : You think about your budget in buckets according to a hierarchy of importance. Here are five of the most popular budgeting techniques touted by professionals-and how they fared in our testing. “The most important thing is that you pick a strategy that really resonates with you.” The more comfortable you are with that strategy, you’re more likely to implement it and stick with it.

“Everybody’s different,” says Greg Giardino, a Tarrytown, N.Y.-based certified financial planner. One thing they stressed: There’s no one-size-fits-all budgeting solution. My main objective with my money is to make sure I’m taking care of my expenses while also saving for a down payment on a house.įor help, I turned to certified financial planners. I’m a married 30-something with no children who lives in New York City. But that can be a time-consuming process, so we put the most popular budgeting methods through our testing process over several weeks to see which ones work best for a regular person. To sort out which type of budget might work best for you, and if you need a budget at all, can take some experimentation. There are just about as many approaches to handling your daily finances as there are to counting calories. Trying to get your spending under control? Just like with dieting, it can help to add some structure by following a plan, especially if your budget is likely to be bigger because of inflation, as The Wall Street Journal newsroom has advised.

0 kommentar(er)

0 kommentar(er)